Being on the road means that pulling into your regular banking institution back home becomes a thing of the past.

Being on the road means that pulling into your regular banking institution back home becomes a thing of the past.

So, with your financial wellbeing requiring that you take care of business on a regular basis, how is it that full time RVers are able to take care of their debits and credits in a punctual manner?

Modern banking — including Internet banking — makes managing your finances so easy and accessible that you can travel on any schedule and know that everything is well taken care of.

The first step is choosing what bank you want to use.

ATM Machines & Cash

If you plan on making use of ATMs for those times when you need good old greenbacks, then choosing a national chain (like Chase or Bank of America) will save you at least one side of the fees accessed when you use an out-of-town ATM.

When you use an ATM that is not part of your home banking system, you will be charged a fee up to about $4 — both from the owner of the ATM machine you use and from your own bank for handling the transaction.

You can avoid at least half of these charges with a nationwide chain that will have ATMs in every major city.

You can avoid at least half of these charges with a nationwide chain that will have ATMs in every major city.

By using debit cards or credit cards, your need for cash will be minimal. In many ways, this is a safer approach. All credit cards and some debit cards have a maximum liability of $50 if they are stolen or lost and used by an unauthorized person. Many banks have zero liability, even better.

Keeping your on-hand cash levels low is the best way to minimize your losses, in the event that someone intends to do you wrong.

Paying Bills

Today, paying bills is as easy as clicking the mouse on your computer, thanks to online billpay.

Today, paying bills is as easy as clicking the mouse on your computer, thanks to online billpay.

Most companies will let you make payments through electronic fund transfers (EFTs) — the equivalent of writing a check, only it’s done over the Internet.

In most instances, you can arrange for automatic payments to be transferred on a specific schedule. That way, when you get side-tracked at the Grand Canyon and forget, the payments will still be sent on time.

Depositing Money

Making deposits is equally easy.

Most employers offer direct deposit, as does Social Security. If your income includes dividends from stocks or annuities for example, they also can be set up as a direct deposit.

In the rare instance that you receive checks that must be deposited with a nationwide chain, you can cash or deposit them at any bank branch.

If you do business with a smaller local bank or Credit Union (as I do), you can always send checks for deposit through the mail. Be sure to endorse them as “For Deposit Only” and include a deposit slip if your bank requires it.

Balancing Your Checkbook

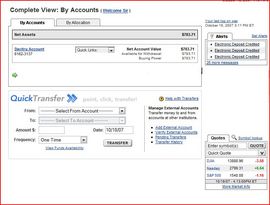

Balancing your account is as easy as opening your bank’s website (after you’ve established an online banking account).

Balancing your account is as easy as opening your bank’s website (after you’ve established an online banking account).

The Credit Union I use has “real time” online access. That means when I transfer funds online, my account immediately shows that I have done so. With the current balance available 24 hrs a day, I find I balance my accounts at least once a week.

I still get paper statements every month, but by the time they arrive the information is out of date and useless. I can more easily track my current financial position on my laptop computer, making use of wireless Internet services that can be found almost anywhere.

Banking From The Road Is Easy!

In many ways, the methods you will use to accomplish your banking on the road are much quicker and more convenient than conventional banking practices.

Even securing a loan for that new dream RV while you’re on winter hiatus down south is as easy as turning on your laptop and making a few inquires on the Internet.

You can also check your credit report, and get pre-approval before you even pay admission to the big RV show that is taking place right around the corner!

More RV Banking

- Fulltime RVers Share Great Nomadic Banking Options

- Bank of Internet USA & Camping World Form Alliance

- RV Mail Forwarding, Banking & Credit Cards

I’ve been involved in RVing for over 50 years — including camping, building, repairing, and even selling RVs and motorhomes. I’ve owned, used, and repaired almost every class and style of RV ever made. I do all of my own repair work. My other interests include cooking, living with an aging dog, and dealing with diabetic issues. If you can combine a grease monkey with a computer geek, throw in a touch of information nut and organization freak, combined with a little bit of storyteller… you’ve got a good idea of who I am. To date, I’ve shared my RV knowledge in over 300 articles here at The Fun Times Guide! Many of them have over 25K shares.